Highlights

- The transaction is worth Rs 31,700 cr

- The all-equity merger deal includes an exchange ratio of 4.39 HUL shares

- With the HUL deal, the 140-year old brand will retain its British ownership

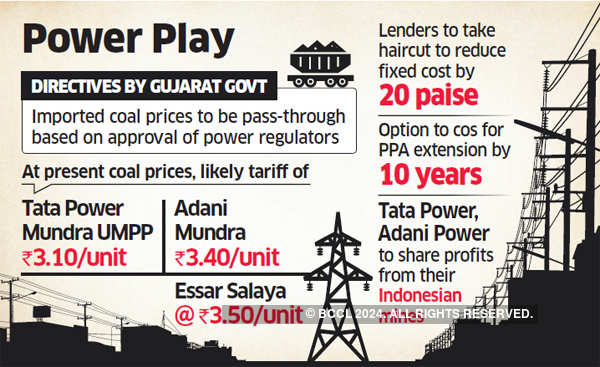

In a big relief to Adani Group and Tata Power, the Supreme Court on Monday allowed state discoms and power producers move CPEC

In a big relief to Adani Group and Tata Power, the Supreme Court on Monday allowed state discoms and power producers move CPEC

|